Contents

eToro, our reccomended platform for acquiring NEO in Nigeria

Why do we recommend it?

- It is possible to invest in countless of other goods

- You can trade leveraged

- User-friendly and simple

- You can copy investment moves

- You can go short

Official page: www.etoro.com/neo

In case you are considering it, eToro is the best option to purchase NEO from Nigeria.

This broker is famous for making “social trading” fashionable, a revolutionary way of investing in which users can replicate the movements of other traders who have been making earnings for years.

eToro has solutions for you, especially if you don't have much experience in trading, because it puts your investment on autopilot by imitating moves from those who have been doing it for years. Additionally, in case you do have experience in investment, the platform pays you for sharing it with the community.

Another thing to mention is how easy the platform is, which turns out perfect for new users that are just learning all about NEO.

Can you trust eToro?

eToro has been independently tested many times to validate its fidelity in displaying previous performance statistics. The results have always confirmed that eToro is meticulous with the information.

Legally, eToro complies with all the demanding regulations requested by the European Union. Its head office is in Cyprus, where it is approved by the CySEC or Cyprus Securities Market Commission, which protects up to € 20,000 of the debts that its clients may have with creditors (those from Nigeria included).

eToro is backed by the European Financial Instruments Market (MiFID), and by the Financial Conduct Authority or FCA in the USA. You should also know that it has a trajectory of fifteen years, with more than 20 million users around the world. So, you can be sure that your finances are safe.

It is also important to mention the good functioning of its customer service. You can contact them by phone or use their live chat.

How to deposit funds into your eToro account

When it comes to payment on eToro, there is not much to say, since it is really straightforward. Just click “Deposit funds”, type an amount, and choose the payment option you prefer. You can pay with PayPal, bank transfer, credit card (Visa, MasterCard, Diners, Visa Electron and Maestro), Skrill, or Neteller.

Remember that for security policies, you need to be the owner of the account or the credit card.

You can start with a $ 200 deposit, and if you are not verified you will have a maximum amount allowed. So, if you intend to operate with large amounts, you will need to verify your account previously.

The platform accepts transfers in any currency, but you will have to pay a fee for the conversion to USD. That is why we recommend, if possible, using USD from the beginning.

What are ETFs?

What do you know about Exchange-traded funds? They are similar to index funds and are known for merging the benefits of stocks and mutual funds, because they can be exchanged regularly at market price, but include a much wider diversity of assets and the fees are significantly lower.

What is an ETF?

ETFs or Exchange-Traded Funds are a type of passively managed fund, similar to index funds. They can be described as a merge between stocks and mutual funds. They are publicly traded and therefore can be commercialized at any moment at market price. But their advantage is that they are more diversified compared to stocks, and the rates are much lower than those of an actively managed fund.

About Index Funds

Are most adequate for those interested in long-term investments, particularly for beginners. If you don't need to withdraw your money in less than five or ten years, index funds offer you security and diversity.

Contrary to common perception, it is very hard to beat the market (yes, you have surely heard of investors who obtain huge returns).

But putting aside some exceptional cases (like Warren Buffett's), not everything is as good as it sounds: when someone brags about having beaten the market, it was probably for a short time, or their charges are really high. Besides, if something happened once or twice, it doesn't mean necessarily that it will happen again in the future.

Index funds offer these two great advantages: most of the time, they beat active managers in the long term, and the fees are lower than you imagine.

Foreign exchange

Foreign exchange trading or Forex consists, as the name says, in the exchange of currencies. It's the conversion between currencies to make a profit through the operation.

If you decide to trade the EUR/USD pair, you buy euros at their price in dollars, hoping that the euro will raise its price compared to the dollar. Therefore, if you bought each euro for 1.15 USD and you sell them back when their price is 1.20 USD, that margin will be yours.

You may be thinking by now that operating with currencies requires investing considerable amounts, and you're right, since increases in prices are never that dramatic, and if you use a lot of leverage to counter that, you will take a considerable risk. If you are just starting to trade, it is not a good idea to begin with this market, because it is very risky and complex.

Most currencies are available on eToro but consider that Forex trading functions through CFDs, which means you will not be the owner of the underlying asset.

Equities

Let's discuss the most well-known assets: stocks. Stocks are the parts of publicly traded enterprises. It is possible to own a proportion of a company and have returns, but you must know where to invest your money.

We could say that there are two main types of shares: the ones that divide their earnings regularly among the shareholders, and those that don't payout. The former ones are great, obviously, but investing in the latter can also be a good idea since the profit you can make by selling the shares can be even larger.

When trading on eToro, if you choose a company that pay out dividends, these will be deposited into your account, and you can withdraw those funds or invest them back. Our suggestion is, if you don't need the money right away, that you take advantage of compound interest and reinvest it in the company itself.

If you trade with stocks on eToro, you can use leverage to “dope” your trades. However, we don't recommend that, since it would be a CFD and you would not get dividends. Besides, equities are regularly long-term investments, and you have to pay commissions.

What are Contracts for Difference?

It is possible that you have found the initials CFD repeatedly if you entered eToro before. We will explain exactly what this means, but you should know first that CFDs on eToro are only possible if you go short.

We will also explain terms such as short-selling and leverage, in case you are thinking about day trading cryptocurrency or more advanced practices.

With CFDs you can bet on eToro even if you are not “in the black” or having a negative balance. For instance, you are sure that the NEO will go down, so you obviously think “if it is going to depreciate (go down in price), I simply wait and I'll go in when it has gone down”. However, if it really falls, it might mean extra money for you.

You can accomplish that by “going short”. Here's how it works ,roughly:

- You obtain from a loan 100 units of NEO, which cost $ 5,000 (these are completely made up numbers)

- Next, you make $ 5,000 by offering them at their price in the market

- The NEO devaluates from $ 50 to $ 30

- You purchase all 100 units again, but at the current price, $ 3,000

- Then you return the 100 units

- You keep the $ 2000 difference!

It all seems more tricky than it really is. Just keep in mind that by trading in NEO on eToro, you can make money if you anticipate downs in the price.

How does eToro work?

We said previously that eToro is very friendly and intuitive. Anyone can start using it without previous knowledge or long explanations.

Everyone who has previously used social networks like Instagram or Linkedin, has enough knowledge to operate with the eToro interface.

We will talk about how to register and the different sections of eToro that you should know.

You will have to fill in some information requested when registering.

Additionally, you will have to answer some questions about your experience at investing.

But don't worry: it is not an exam. It is only a way of finding out how much knowledge you have and what type of financial instruments they can recommend. For instance, if it is your first experience in the investment world, they will not suggest that you invest in futures.

Now we will explain the fundamental sections of the page.

With the “Set Price Alerts” tool, you'll be able to program an alert when an asset is at a certain price. This is helpful if you want to buy a security and you are waiting for it to decrease.

In “News Feed”, users interact and share opinions, tips, and other valuable information.

“Instruments”, “People” and “CopyPortfolios” are within “Discover”. And we discussed previously in this guide the kinds of assets that are available on eToro:

- Cryptocurrencies

- ETFs

- Stocks

- Raw materials

- Forex trading

- Index funds

The concept “social trading” comes to life within “People”: that is where you can copy the strategies of the best investors.

Using the search box, you can find the investors that you find more interesting: by average earnings, market or risk level, for instance. You just have to choose the amount you want to invest and eToro itself will be in charge of replicating the movements made by the selected investor, in proportion. “In proportion” means that if you have $ 1000 and the investor puts 10% in an asset, the platform will invest also 10% of your money (that is, $ 100) in that same asset.

Also, here you will see CopyPortfolios classified into three categories, Top Trader, Market, and Partner.

In some cases, it might be better to copy from CopyPortfolios than to other investors, because the former offer more diversity. There are all kinds of portfolios that you can find easily and are classified by sectors. So, if you suspect a specific industry, like gaming or healthcare, will have good incomes in the future, you should look for that specific portfolio.

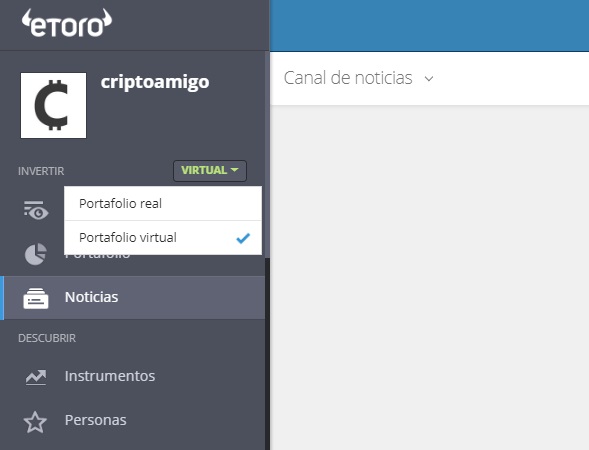

Virtual portfolio

If you do not have much experience investing, you can start by practicing with a “demo” option. You just have to set the “virtual” option” in the upper left corner and your operations will be carried out with “imaginary” funds.

A virtual account can be a good way of practicing before starting to operate with real money. When you open your demo account, you will begin with a virtual amount of $ 100.000, to trade with a variety of financial instruments available on the platform, besides NEO.

The first attempt is not usually that good. But don't worry, because you can ask support to deposit back the virtual $ 100k to your portfolio, and the second time you should do better.

Keep in mind that you should always be cold-minded when trading, and perhaps a practice account can prevent you from controlling your impulses. It is not the same to trade with your own money than with fake funds, which you can lose without a problem.

As you may suppose, the virtual mode is kind of absurd if you intend to invest in the medium or long-term (with almost guaranteed returns only by replicating an index), since you would be wasting years. Demo accounts may be helpful for trying out before trading in the short or medium-term.