Contents

eToro, our favorite option for purchasing Gram in Nigeria

Why do we recommend it?

- It offers strategies from skilled traders so you can emulate them

- You can go short

- It is really straightforward and user-friendly

- eToro offers leverage

- It is possible to invest in countless of other products

Go to the official site in English: www.etoro.com/gram

You should consider eToro in case you are thinking about acquiring Gram from Nigeria.

eToro is well-known for making “social trading” fashionable. Social trading is an ingenious form of investing in which investors can replicate the techniques of other traders who have been generating income over time.

eToro has solutions for you, especially if you don't have much experience in trading, because it automatizes your investment by repeating strategies from other experienced people with a long profit history. On the contrary, if you are an expert in the subject and decide to share your knowledge with the community, eToro rewards you with money.

Another advantage is how intuitive the platform is, which turns out perfect for new users that are just learning all about Gram.

How are CFDs and futures different?

Here are the most important differences between CFDs and Futures, in case you want to know more:

- Counterparty

- Futures: operations are made with someone else, another trader.

- CFDs: the counterparty is the brokerage, in this case, eToro. That means you don't “play” with someone else but with the bank.

- Expiration date:

- Futures: they have an expiry date. Once the contract expires, it is closed and can't be reopened.

- CFDs: on the contrary, there is no expiration date. It is possible to get back to a good position before closing.

- Options for trading:

- Futures: it is more restricted

- CFDs: a lot of variety, there are CFDs of practically anything

- Minimum deposit:

- Futures: very high minimum investment

- CFDs: it is very low

- Pricing and rates:

- Futures: costs are usually lower

- CFDs: costs are higher

- Use of leverage:

- Futures: there is no leverage leverage

- CFDs: fully available

About ETFs

Exchange-Traded Funds or ETFs are similar to index funds. They can be described as a combination of stocks and mutual funds, including the best of both. They can be traded like regular stocks, but include a wide diversity of assets and the rates are much lower than those of an actively managed fund.

Foreign exchange

Currency trading or Forex consists, as the name says, in the trading of currencies. It is the conversion between a pair of currencies, and the aim is, evidently, to obtain a benefit out of this.

If you decide to exchange the EUR/USD pair, you speculate how many dollars it will take to buy a euro, hoping that the euro will raise its price compared to the dollar. Then, if you purchased each euro at 1.15 USD and you sell them back when their price is 1.20 USD, you'll be earning that margin.

As you may have deduced, trading with currencies usually implies large resources, because prices never increase that much, or using a lot of leverage, which is a bit like skating on thin ice. If you are a novice in trading, we don't recommend beginning with this market, because it is very risky and intricate.

You can operate with the most common currency pairs on eToro but take into account that in this market sales are made through CFDs, which means you will not be the owner of the underlying asset.

Shares

Stocks or shares are the most popular financial assets. Some publicly traded enterprises decide to split into fractions and have many shareholders. By investing money in them, you can own a portion of a company and obtain dividends.

Basically, there are two kinds of stocks: the ones that divide their earnings regularly among the stockholders, and those that don't. The former ones are great, of course, but investing in the latter can also be a good idea since the profit you can make by selling the shares can be even larger.

In the case of eToro, if you choose a company that pay out dividends, these will be deposited into your account, and you can withdraw those funds or reinvest them. Our suggestion is, if you don't need the money right away, that you don't renounce the magic of compound interest and reinvest it in the company.

If you invest in stocks on eToro, you will be able to use leverage to “dope” your trades. However, we don't recommend that, since it would be a CFD and you would not get dividends. On top of that, as shares tend to be long-term investments, you will have to pay commissions as long as your operation is open.

About ETFs

What do you know about Exchange-traded funds? They are similar to index funds and are known for combining the advantages of stocks and mutual funds, because they can be traded at any moment in the market, but offer much more variety and the rates are significantly lower.

About Index Funds

Index funds are most adequate for those interested in long-term trading, mostly for beginners. If you don't need an amount of money for the next five or ten years, index funds are a safe option.

Unlike a lot of people think, beating the benchmark is far from being a piece of cake and very few fund managers have done it, apart from some famous cases.

In practice, if a fund manager achieves to beat the benchmark, it is only for a short time or on a specific occasion. Or perhaps they would charge very high rates and indexing would be a better decision anyway.

The great advantage of index funds is that they solve both issues: their commissions are minor and they beat active managers almost all the time, although in the long term.

Raw materials

The major benefit of trading with commodities is that their price varies less than that of other financial products. In fact, their stability is what makes most people choose raw materials when facing market volatility or inflation. Despite that, the cost of commodities is determined by supply and demand, so if faced with the fear of inflation, demand rises a lot, so will the price.

Remember that the only intended income from the investment in raw materials will be the hypothetical capital gain after the sale since, unlike shares, these don't distribute dividends or pay interest.

There are two basic kinds of commodities: hard raw materials and soft raw materials. The former include precious metals (such as gold, silver, copper, and platinum), industrial metals (for instance, aluminum, iron, or zinc), and oil; while the latter are agricultural products as wheat, soybeans, vegetables, or even dairy, among many others.

Investment strategies

There are lots of ways to trade cryptocurrencies: from buying and waiting to day trading (and benefit from price fluctuations).

My recommendation for those who are starting to trade is something in the middle: placing a dynamic stop-loss (15-20% under the highest price) when you open your operation and wait for it to work its magic.

For example, if you purchase a cryptocurrency at $ 15, it rises up to $ 25 and falls back to $17, the stop-loss will close your position at $ 21 or $ 22. Hence, you will obtain a fine profit.

You may be wondering: why not selling back when the price is at its maximum? But that would only work for a psychic or a fortune-teller. The mentioned method is completely realistic and can work out perfectly.

Later on, you will be able to apply more sophisticated strategies, like short-selling or using leverage.

Payment methods on eToro

When it comes to depositing funds on eToro, there isn't really much to say, since it is pretty simple. You only need to select “Deposit funds”, set an amount, and choose your payment method. You can pay with PayPal (available for some countries), bank transfer, credit card, Skrill, or Neteller.

Remember that for security reasons, you need to be the holder of the account or the credit card.

You can start from $ 200, and if you are not verified you will have a maximum amount allowed. Thus, if your intention is to deposit higher amounts, you should contact Support to verify your account.

You can make the payment in any currency you want and eToro will automatically convert it to USD. However, it is better to use USD anyway since the platform charges a fee.

Can you rely on eToro?

eToro has been independently tested several times to verify its reliability in the treatment of data from previous users. Every time, results have shown that eToro is very meticulous with the information.

The main office of eToro is in Cyprus, and the platform is certified by the Cyprus Securities Market Commission (known as CySEC), which can cover up to € 20,000 from its client's debts, including those from Nigeria. The platform complies, on the other hand, with all the strict policies of the European Union.

It is also supported by the European Financial Instruments Market or MiFID, and in the USA it is under the control of the Financial Conduct Authority (FCA). Besides all these regulations, eToro has worked for fifteen years and that it has more than 20 million users, so we can be sure that our funds are in good hands.

Their excellent customer service is also worth mentioning. You can contact them by phone or use their live chat.

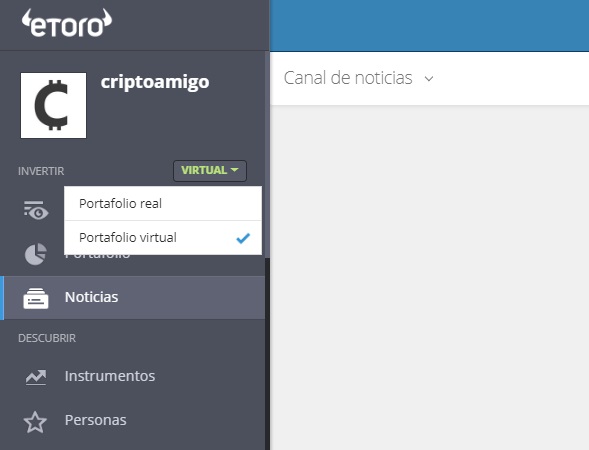

How does a demo account work?

In case you are taking your first steps as an investor, the option to operate in “demo” mode may be useful. You only need to set the “virtual” option and your operations will be carried out with an imaginary balance.

This option is great for those who are new to this world and want to put their talents to the test before playing for real funds. When you open your account, you will start with $ 100,000 of virtual funds to do your operations, not only with Gram, but you can also work with a diverse portfolio with a variety of assets.

Don't worry, since if you lose all your virtual funds, you can contact support so they can add back the $ 100k to your portfolio and you can try again.

Take into account that you should always be cold-minded when investing, and using a virtual portfolio might have the opposite effect. It will never be the same as risking your own money.

And of course, the virtual mode is kind of pointless if you intend to invest in the medium or long-term, since you would be wasting years. Demo accounts may be ideal for trying out short or medium-term operations.

eToro Interface

We mentioned before that eToro is very friendly and intuitive. Anyone can start using it without previous knowledge or long explanations.

You won't have any problems with the interface if you are familiar with any other social network, like Pinterest or Whatsapp.

Now we are going to walk you through the registration process and the different sections of the eToro interface that you should familiarize yourself with.

When you open your account, you will have to fill in your personal data, like first name, last name, address….

Additionally, you will see that they ask you some questions about your experience at investing.

However, it's not like they're testing you or anything. They are only measures to know how much knowledge you have and what type of financial instruments they can recommend. For example, if it is your first experience in the investment world, they will not recommend that you invest in futures.

When you finish with all the requested information, you will stop seeing the “incomplete profile” message.

Now we will explain the different sections of the platform.

With the “Set Price Alerts” tool, you'll be able to program an alarm when a security is at a certain price. This is ideal in case you want to buy an asset that is falling but you believe it will decrease more to a certain point.

The section “News Feed” allows users to interact and learn from each other by sharing their opinion and experiences.

“Instruments”, “People” and “CopyPortfolios” are within “Discover”. And we discussed previously in this guide the kinds of assets on eToro:

- Cryptocurrencies

- Exchange-Traded Funds

- Shares

- Commodities

- Forex trading

- Index funds

The term “social trading” makes sense within “People”: that is where you can duplicate the movements of any investor you choose. You'll be able to see all their profiles and historical performances.

You can find those traders that you find more interesting. When you select an investor and indicate how much money you want to invest, eToro will automatically replicate their movements, proportionally. For example, if you have $ 1000 and the user puts 20% of their funds in an asset, eToro will also invest 20% of your money in the same company or instrument, in this case, $ 200.

Lastly, you will also see the CopyPortfolios divided into three main kinds: “Top Trader”, “Market” and “Partner”.

The benefit of copying to CopyPortfolios instead of particular investors is that this way the risk will be more diversified. There are all kinds of portfolios that you can identify easily and are divided by sectors. Thus, if you think a specific sector, like biotechnology or oil, will prosper in the future, you can look for that specific portfolio and do your investment.