eToro, our reccomended option for buying NEO from Bangladesh

Why do we recommend it?

- It's really straightforward and manageable

- You can imitate other investment tactics

- Accepts short-trading

- eToro offers leverage

- There are lots of investment options

Main site: www.etoro.com/neo

In case you are interested in obtaining NEO from Bangladesh, eToro may be the best way to do it.

eToro is famous for making “social trading” fashionable, an ingenious form of investing in which traders can repeat the strategies of other investors who have been making profits over time.

eToro has solutions for you, especially if you don't have much experience in trading, since it automatizes your investment by repeating strategies from experienced traders with a long profit history. And for those skilled investors willing to share their techniques with the community, eToro rewards your knowledge with money.

It is also very convenient how accessible is this platform, ideal for beginners who are starting with NEO.

Are you familiar with the term “leverage”? Just in case, we'll put it simply:

the good thing about trading is that it lets you invest more money than what you really have. Let's say that you have $ 100 and you use x2 leverage, the amount of your investment will be $ 200.

About leverage, Take Profit and Stop Loss

Suppose now that you know that NEO is going to appreciate, thus you want to take a long position.

You are positive that NEO will go up, but you only have $ 1,000 available. Despite that, why miss the opportunity to make more money?

There's the possibility of requesting a loan, but you must know that all the process takes time, and when you receive the money, NEO might be already at a much higher price, so you wouldn't be able to invest the way you planned.

With leverage, you can obtain that amount of money really easily. It's just like borrowing money, but much better: you will get it from eToro, which allows you to invest much more than you have on the platform. As in the image below, you will see the different options you have:

Within other markets, the leverage you can choose is higher. Why? Because leverage is most used for short-term operations, and cryptocurrencies tend to be a medium or long-term investment. That said, I'm going to explain better how leverage works:

- If you decide to invest $ 1,000 and you use leverage x2, you will be starting with $ 2,000 ($ 1,000 was “borrowed” from eToro).

- A few days later, NEO does increases, as you thought, and now the cost of your investment is $ 2,400 (20% higher), so you decide to sell back.

- The $ 1k of leverage will be deducted, and you will have $ 1,400 left; which means you've earned $ 400, since the other $1,000 was yours from the beginning.

By starting with $ 1000 and getting $ 400, you'll be earning 40% of your investment. That is pretty good.

But watch out: if all goes as you intended and the price rises, you will make money. On the contrary, if the asset decreases, you will also lose more money in the blink of an eye.

Let's imagine that the price didn't increase by 20%, but it decreased also by 20%, you won't lose $ 20 but double, $ 40. That is why to operate with leverage it is fundamental to know about Take Profit and Stop Loss.

Take Profit is used as a form of reducing risks when trading. When you enter, you can set a profit limit and ask that your position is automatically closed when the asset reaches a price.

If you bought NEO at $ 100, you program eToro to close your operation when it reaches $ 120. That way, you make sure you won't change your mind and decide to wait a bit longer in case it keeps going up, which could be a mistake since the price could go down again.

On the other hand, when using leverage you should always use Stop Loss, because a small fall in the price of an asset can lead to a substantial loss. For that reason, it is vital to mark a Stop Loss lower than that suggested by the broker.

What is an ETF?

What do you know about Exchange-traded funds or ETFs? They are similar to index funds and are known for merging the benefits of stocks and mutual funds, because they can be exchanged at any moment in the market, but have much more investment possibilities and the fees are significantly lower.

What is an ETF?

Have you heard about Exchange-traded funds or ETFs? They are similar to index funds and are known for combining the benefits of stocks and mutual funds: they can be traded at any moment in the market, but include a much wider diversity of assets and considerably lower fees.

Foreign exchange market

Forex or currency trading is the exchange between two currencies.

If you decide to exchange euros and dollars, you acquire euros at their price in dollars, with the expectation that after buying the first currency (the euro) it will increase compared to the second (the dollar), to make a profit by selling it. Suppose you entered when a euro is worth 1.10 USD and you leave when it reaches 1.15: consequently, you will gain that margin.

You may be thinking that trading with currencies requires high investments, and that is correct, since increases in prices are never that dramatic, and often you will need to use high leverage (which sometimes can be too much of a risk). Our advice for those starting in the world of trading is to choose another market to begin with, since Forex is not the safest.

You can operate with almost every currency on eToro but bear in mind that in this market sales are always made through contract for differences, so the underlying asset won't be yours.

How does eToro work?

We already mentioned that one of the best things about eToro is how simple it is. You don't need to read a lot or have previous knowledge to start investing.

Everyone who has previously used social networks like Whatsapp or Facebook, has enough skills to use eToro.

We will explain, roughly, the registration process and the different sections that you will find on the platform.

First, you will have to enter your personal data, like first name, last name or address.

They will also ask you about your previous experience as an investor.

But you don't need to worry: it is not an exam. It is only a way of finding out how much knowledge you have and what type of assets they can suggest. For instance, if it is your first experience in the investment world, they will not suggest that you invest in futures.

When you fill in all your information in your profile, the “incomplete profile” bar will disappear.

Let's see what the different sections of the page are.

“Set Price Alerts” allows you to set alerts on the price of certain assets. You only need to click on the three points at the end of the line and you will be able to program a price alert. It is a very useful tool for when you want to buy a security which price is decreasing, but it seems to you that it will decrease even more.

In “News Feed”, users interact and share valuable information.

“Instruments”, “People” and “CopyPortfolios” are within “Discover”. As we mentioned in this guide, the six types of instruments on eToro are:

- Cryptocurrencies

- ETFs

- Stocks

- Raw materials

- Forex

- Index funds

In the section “People” are all the profiles and historical performances of other users, and you can replicate their strategies with just one click. This is where the “social trading” concept is best applied.

Using the search bar, you can find the investors that best suit your interests: by average earnings, types of assets or risk level, for instance. Just indicate the amount of your investment and eToro will be in charge of replicating the movements made by the investor you chose, in proportion. This means that if you put $ 1000 and the investor puts 10% of their capital in Amazon, eToro will also invest $ 100 of your money in the same company.

In this section you will also see the three most popular types of CopyPortfolios, which are Top Trader, Market, and Partner.

In some cases, it might be preferable to copy from CopyPortfolios than to particular traders, since you avoid putting all your eggs in one basket. There are all kinds of portfolios that you can identify easily and are classified by sectors. Thus, if you suspect a specific industry, like gaming or healthcare, will have good incomes in the future, you should probably look for that specific portfolio.

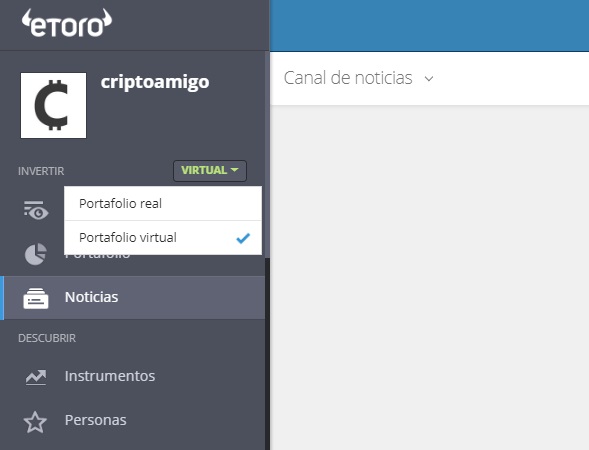

Virtual portfolio: How does it work?

Are you taking your first steps as an investor? Using a demo account can be useful. You just need to set the virtual mode and you can start trading with fictional funds.

This can be a great way of gaining experience and confidence before trading with real money. The platform will give you an amount of $ 100.000 (“fake” or virtual, of course) to begin with, and you will be able to trade with a variety of financial instruments in your portfolio, not only with NEO.

Don't worry, since if you lose all your virtual balance, you can contact support so they can add back the $ 100k to your portfolio and you can try again.

However, remember that investing is mostly about being prudent, and using a demo account can have the opposite effect. It is completely different to risk your real savings than to do operations with a false balance which loss does not suppose any drama.

Finally, if you intend to invest in the medium or long-term, with profits almost assured just by replicating an index, it is absurd that you waste years investing in virtual mode. On the other hand, short or medium-term operations are ideal to try out with the virtual mode.