Contents

eToro, an advisable online broker for obtaining Dash from Ireland

Some of its advantages are:

- Allows to replicate investment moves

- Allows you to short sell

- Really user-friendly and straightforward

- Leverage is allowed

- It is possible to make investments in plenty of different goods

Official site: www.etoro.com/dash

You should consider eToro in case you are interested in acquiring Dash from Ireland.

eToro is popular for making “social trading” a trend. Social trading is an innovative way of investing in which traders can repeat the moves of other investors who have been making profits for a long time.

If you are still a rookie or do not have much investment experience, eToro is great for you, because it automatizes your investment by replicating moves from those who have been doing it for years. And for those skilled investors willing to share their techniques, eToro rewards your knowledge with money.

It is also very convenient how easy is to manage this platform, excellent for beginners who are starting with Dash.

Differences between futures and CFDs

What are the differences between Futures and CFDs?

- Who is the counterparty? With Futures, the counterparty is another investor. In CDFs, it’s the brokerage, in this case eToro

- Expiry date Futures have a determined expirationdate, while CFDs don’t have expiration date

- Variety of options for trading The market for Futures is narrower. CFDs include a wide range of possibilities.

- Minimum investment Costs for Futures are higher than costs for CFDs.

- Use of leverage With Futures, it isn’t possible; while with CFDs it is.

Investment strategies

You can trade cryptocurrencies in many different ways: for example, you can buy and hold, or you can day trade (taking advantage of price volatility).

My suggestion for those who are starting to invest is going halfway between the two options: when you open your position, set a stop-loss 15-20% below the top price, and forget about the operation.

This means that if, for example, you acquire a cryptocurrency at $ 10, it goes up to $ 20 and then falls to $ 12, your position will be closed at $ 16-17 and you will have made a decent profit.

It may sound more appealing to sell when the price is at its maximum, right before corrections, but unless you're clairvoyant, that's impossible. The above method is much more down-to-earth and it can give great results.

Sooner or later, you will be prepared for applying advanced trading strategies, like using leverage or going short to profit from bear markets.

Payment methods on eToro

When it comes to depositing funds on eToro, there isn't really much to say, since it is pretty simple. You just have to click “Deposit funds”, put an amount, and choose the payment option you prefer. You can pay with PayPal, bank transfer, credit card, Skrill, or Neteller.

(Keep in mind that you should be the account or credit card owner, for security policies).

The lowest amount you can deposit is $ 200, and there is a maximum authorized if you are not verified, so if you want to trade with higher amounts, contact Support beforehand to verify your account.

Finally, remember that you can make the transfer in any currency because eToro defaults all deposits to USD, although it charges a fee, so it is preferable to make the transfer directly in USD.

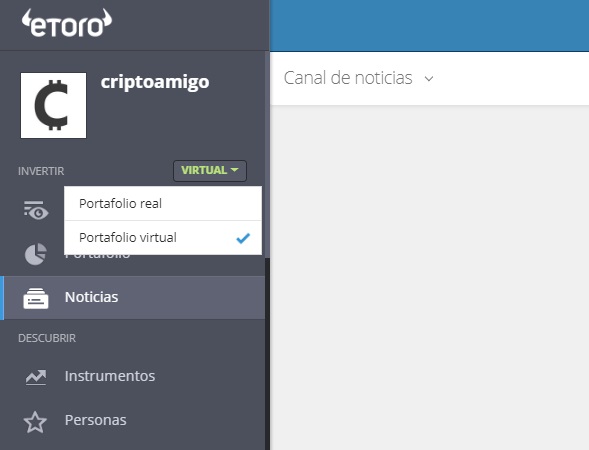

How does a virtual portfolio work?

In case you do not have much experience investing, you can start by practicing with a “demo” option. Setting a virtual account and trading with fictional funds is very simple.

This is a great tool for those who want to give it a few tries before trading with real funds. When you create your account, you will start with $ 100,000 of virtual balance to do your operations, not only with Dash, but you can also work with a diverse portfolio with a variety of assets.

The first attempt is not usually that good. But don't worry, since you can ask eToro to deposit back the virtual funds to your portfolio, and the second try you should do better.

Take into account that you should always be prudent when investing, and perhaps a practice account can prevent you from controlling your impulses. It is not the same to trade with your own money than with virtual funds, which you can lose without any consequences.

Finally, the demo mode is kind of absurd if you intend to invest in the medium or long-term (with almost guaranteed returns only by replicating an index), since you would be wasting years to see the results. Demo accounts may be useful for trying out short or medium-term investments.

How to use eToro

We already said that one of the best features of eToro is that the platform is very friendly and easy to use. You don't need to read a lot or have previous knowledge to start trading.

You won't have any issues with the interface if you are familiar with any of the most common social networks.

We will explain the registration process and the different sections that you will see.

You will have to fill in some information requested when registering.

They will also ask you about your previous trade experience.

But don't worry: it is not an exam. They only intend to know how much knowledge you have and what type of financial instruments they can suggest. For example, if you have never invested before, they will not recommend that you invest in futures.

When you fill in all your information in your profile, you will stop seeing the “incomplete profile” message.

Let's review the different tabs of the interface.

With the “Set Price Alerts” tool, you'll be able to program an alarm when a security is at a certain price. This is perfect in case you want to buy a security and you are waiting for it to decrease.

The section “News Feed” allows users to interact and learn from each other by sharing their opinion and experiences.

“Instruments”, “People” and “CopyPortfolios” are within “Discover”. And we discussed previously in this guide the kinds of assets that are available on eToro:

- Cryptocurrencies

- Exchange-Traded Funds

- Shares

- Commodities

- Forex trading

- Index funds

The concept “social trading” makes sense within “People”: there, you can duplicate the trading strategies of the investors you find most inspiring with just one click. You'll be able to see all their profiles and performances.

In this section, you will be able to search and find users according to your interests. When you choose an investor and indicate the amount you want to invest, eToro will automatically replicate their movements, proportionally. For instance, if you invest $ 1000 and the trader puts 20% of their funds in an asset, eToro will also invest 20% of your money in the same asset, in this case, $ 200.

You will also see the three main types of CopyPortfolios, which are “Top Trader”, “Market” and “Partner”.

The benefit of copying to CopyPortfolios instead of individual traders is that this way you will diversify the risk. Besides, the portfolios are easily identifiable: one about gaming, another about large drone companies, another about pharmacy … You think that a certain industry will prosper anytime soon? Then look, because surely there is a CopyPortfolio about it.