Contents

eToro is an outstanding broker for those in Bangladesh who want to buy Litecoin

Why do we recommend it?

- It's really simple and manageable

- Allows to copy investment strategies

- Admits “shorting” or short-selling

- You can leverage

- Allows you to invest in thousands of different goods

Official website: www.etoro.com/litecoin

If you are interested in investing in Litecoin from Bangladesh, eToro may be the best option currently.

eToro is known for making “social trading” fashionable, an ingenious way of investing in which users can imitate the movements of other traders who have been generating profits for years.

eToro has solutions for you, even if you don't have much experience in trading. You can rest assured that you will be doing a smart investment move when replicating those from subjects with a long profit record. And for those skilled investors willing to share their techniques, eToro pays for it.

It is also very convenient how accessible is the platform, ideal for beginners who are starting with Litecoin.

In case you still don't know what “leverage” is, we'll describe it briefly: it is the ability to use a higher amount than you actually have. For example, if you start with $ 100 and you use x2 leverage, you will be investing $ 200.

Leverage, Take Profit and Stop Loss

Assuming that, for example, you are positive that Litecoin is going up, and that you have $ 1,000 for “going long”, you must know that you can increase your investment and make more money.

You could consider asking for a credit at your bank or other financial company, but you must know that all the process takes time, and when you receive the money, Litecoin might be already so expensive that trading wouldn't be convenient anymore.

Leverage is just like a loan, but it is only a few clicks away! You will be able to invest (and earn) much higher amounts than what you actually have on the platform's wallet. Before trading, you will be able to choose between the different options as in the screenshot below:

With other assets, the leverage you can use is higher. This is because cryptocurrencies are usually medium-long term investments, and leverage is used mainly for short-term operations or day trading. Let's talk a bit more about how leverage works:

- If you decide to invest $ 1,000 and you use leverage x2, you will be starting with $ 2,000 ($ 1,000 was “borrowed” from eToro).

- A few days later, Litecoin does rises, as you thought, and now the price of your investment is $ 2,400 (20% more), so you decide to sell back because you want to play it safe.

- The $ 1k of leverage will be deducted, and you will have $ 1,400 left; which means you've earned $ 400, since the other $1,000 was yours from the beginning.

In conclusion, by investing $ 1000 and obtaining $ 400, your net profit would be 40%. That is pretty decent.

But not everything is wonderful. If all goes as you intended and the asset increases, you will make profits. Nevertheless, if the asset decreases, you will also lose more money than you invested.

Let's suppose that the price didn't increase by 20%, but it decreased also by 20%, you won't lose $ 20 but double, $ 40. That is why the concepts of Take Profit and Stop Loss are fundamental when trading with leverage.

Take Profit is used as a form of reducing risks when trading. When you enter, you can set a profit limit and ask that your position is automatically closed when the asset reaches a price.

If you purchased Litecoin at $ 100, you program eToro to close once it reaches $ 120. That way, you make sure you won't be blinded by greed and decide to keep waiting in case it keeps rising, which could be a mistake since the price could go down again.

Also, if you use leverage you absolutely need to place a Stop Loss order (take into account that any small loss is greater with leverage). Always remember to set a Stop Loss lower than that suggested by the broker.

Can you trust eToro?

Many tests from independent consultants have been applied to eToro to validate its fidelity in reporting performance statistics from previous users. And it has been confirmed every time that eToro is meticulous with the figures.

eToro complies with all the strict policies requested by the European Union. Its main headquarters is in Cyprus, where it is approved by the Cyprus Securities Market Commission or CySEC, which can cover up to € 20,000 of the debts from its clients, including those from Bangladesh.

eToro responds to the European Financial Instruments Market or MiFID, and to the Financial Conduct Authority (FCA) in the USA. Apart from the above, it has a trajectory of fifteen years, with more than 20 million users all over the world. So, yes, it is a safe broker.

No less important is their excellent customer service. You can contact them by phone or use their live chat.

eToro Interface

We said previously that eToro is very friendly and intuitive. Anyone can start investing without previous knowledge or long explanations.

You won't have any issues with the interface if you are familiar with any other social network, like Linkedin or Instagram.

Now we are going to detail the registration process and the different sections of the page that you should know.

First, you will have to enter your personal data, like first name, last name, address….

Additionally, you will see that they ask you some questions about your experience at investing.

But don't feel like you are taking an exam. They only intend to find out how much you know and which assets to recommend for you.

You will see a bar that says “incomplete profile” until you complete all the requested information.

Let's see what the different sections of the page are.

“Set Price Alerts” allows you to put alarms on the price of certain securities. You just have to click on the three points at the end of the line and you will be able to program a price alert. This is very helpful when you are after a security which price is decreasing, but perhaps you think that it has not finished falling yet.

In the “News Feed” tab is the most social part of eToro: where users are interacting all the time and sharing opinions, tips, and other valuable information.

In “Discover” you will find: “Instruments”, “People” and “CopyPortfolios”. And we already discussed the kinds of assets that are available on eToro:

- Cryptocurrencies

- ETFs

- Stocks

- Raw materials

- Forex

- Index funds

In the section “People” are all the profiles and historical performances of other users, and you can replicate their strategies with just one click. This is where the “social trading” term is best applied.

Using the search box, you can find the investors that best suit your interests: by average profits, market or risk level, for instance. You just have to choose the amount you want to invest and eToro will replicate the movements made by the investor you selected, in proportion. This means that if you put $ 1000 and the investor puts 10% of their capital in Amazon, eToro will invest $ 100 of your balance in that asset.

Also, here you will see CopyPortfolios classified into: Top Trader, Market, and Partner.

Sometimes you might prefer copying to CopyPortfolios than to particular users, because the former offer more diversity. The portfolios are identified so you can recognize them easily: one about gaming, another about large drone companies, another about pharmacy … You think that a certain sector is going to have success in the future? Then look, because surely there is a CopyPortfolio about it.

Trading strategies

There are different methods or ways for crypto trading, such as buying and holding or day trading, for naming just a couple.

My recommendation for those who are starting to trade is something in the middle: when you open your Litecoin position, set a dynamic stop loss 15-20% below the top price, and let the rest happen on its own.

This means that if, for instance, you buy a cryptocurrency at $ 10, it goes up to $ 20, and after that it decreases to $ 12, your stop loss will close your position at $ 16-17 and you will have made a decent profit.

Perhaps you are wondering: why not selling when the price is at its highest? But unless you are a psychic, that is just impossible. The mentioned strategy can work perfectly and give good results.

Later on, you will be able to apply more complex techniques, like short-selling or using leverage.

How does a virtual account work?

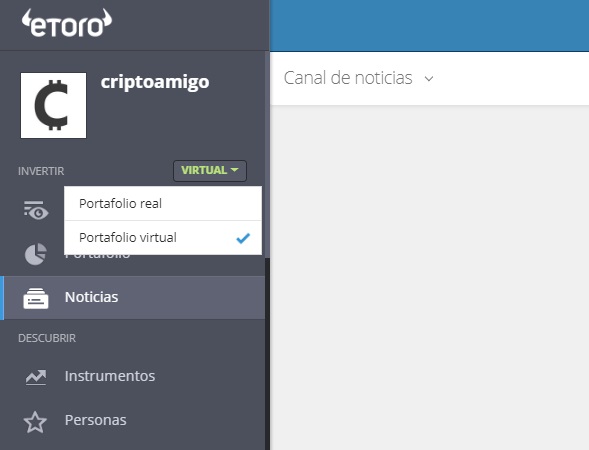

In case you do not have much experience as an investor, the possibility to operate in “demo” mode may be helpful. Setting a virtual account and trading with fictional funds is very simple.

This can be a great way of gaining experience and confidence before trading with real funds. You will have an amount of $ 100.000 (“fake” or virtual, of course) to begin with, and you can trade with all the different instruments available on eToro, not just with Litecoin.

The first attempt is not usually that good. But you can ask support to deposit back the virtual $ 100k to your account, and the second time you should do better.

Nevertheless, remember that investing is mostly about being cautious, and using a demo account can have an adverse effect. It is not the same to risk your real savings than to trade with virtual funds which loss does not suppose any drama. Besides, using fake money can prevent you from learning to control your emotions, something you should be able to do when trading.

Finally, if you intend to invest in the medium or long-term, with earnings almost assured just by duplicating a strategy, it doesn't make sense that you invest in the virtual mode and wait for years. On the other hand, short or medium-term investments are ideal to try out with the virtual mode.