Contents

eToro, recommended broker for obtaining IOTA from Egypt

Pros:

- Really user-friendly and straightforward

- It offers other successful investment strategies so you can emulate them

- You can short sell

- eToro allows leverage

- Allows you to make investments in countless of different goods

Homepage: www.etoro.com/iota

eToro is probably the best option today to obtain IOTA from Egypt.

“Social trading”, an innovative investment method that consists in replicating techniques and strategies from other experienced investors, has become popular because of eToro.

If you are still a rookie or haven't gained much investment experience, eToro is very helpful. You can rest assured that you are doing a smart investment move when replicating those from subjects with a great deal of expertise. Also, in case you do have experience in investment, eToro pays you for sharing it with the community.

It is also worth mentioning how easy is to manage this platform, excellent for new traders who are starting in the investment world.

Futures Vs CFD

How are CFDs and Futures different?

- Counterparty

- Futures: operations are made with another trader.

- CFDs: the counterparty is the brokerage platform (eToro).

- Expiry date:

- Futures: they expire. Once the contract expires, it is closed and can't be reopened.

- CFDs: on the contrary, they don't expire. This means that you can wait until you get in a good position before exiting.

- Trading options:

- Futures: there are fewer options for investment

- CFDs: you have plenty of options to choose from, there is a huge diversity of CFDs

- Minimum investment amount or “trade size”:

- Futures: you have to invest much more

- CFDs: you can enter with a low amount

- Trading costs:

- Futures: as you have to pay more in the first place, costs are lower

- CFDs: fees are higher

- Use of leverage:

- Futures: you can't leverage

- CFDs: fully available

Can you trust eToro?

eToro is very careful with the information about past performances from traders, and its integrity has been independently tested several times.

The main office of eToro is in Cyprus, and therefore the broker is certified by the Cyprus Securities Market Commission (or CySEC), which can cover up to € 20,000 from its client's debts. Furthermore, eToro follows all the strict requirements of the European Union.

eToro is backed by the European Financial Instruments Market (MiFID), and by the Financial Conduct Authority or FCA in the USA. You should also know that it has a trajectory of fifteen years, with more than 20 million users around the globe. So, yes, it is a safe broker.

Their customer service functions perfectly. You can use the ticketing system, an online chat, and they also have a phone number available for assistance.

Practice account: How does it work?

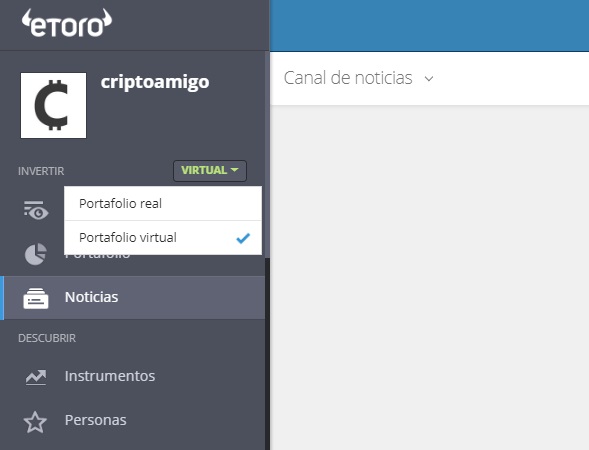

If you do not have much experience investing, you can start by practicing with a “demo” option. You just have to make sure that the “Virtual” option is set in the upper left corner and you will be able to trade with “imaginary” funds.

This can be a great way of practicing before starting to trade with real money. The platform will give you an amount of $ 100.000 (“fake” or virtual, of course) to begin with, and you can operate with all the different assets available on eToro, not only with IOTA.

If your trials don't go well and you lose your funds, there is always a possibility to replenish your virtual funds. Possibly on the second try you will improve a lot.

However, keep in mind that investing is mostly about being cautious, and demo account trading can have the opposite effect. It is completely different to risk your real savings than to operate with virtual funds which loss does not suppose any drama.

As you may suppose, if you want to invest in the medium or long-term, with earnings almost assured only by duplicating an index, it is absurd that you invest in the virtual mode and wait for years. On the contrary, short or medium-term investments are ideal to try out with the demo mode.

eToro Interface

As we have mentioned among the positive aspects of eToro, the best thing about this platform is its simplicity: anyone can use it without having to read endless explanatory texts.

You won't have any issues with the interface if you are familiar with any of the most common social networks.

Let's talk about the registration process and the different tabs you will find on the platform.

First, you will have to fill in all the information that eToro asks for: first and last name, address…

Before you end up with the sign-up process, you will also have to answer some questions about your previous experience as an investor.

But don't feel like you are taking an exam. They only intend to find out about your previous experience and knowledge to know which instruments to recommend for you.

Let's see what the different sections of the platform are.

With the “Set Price Alerts” tool, you'll be able to program an alarm when an asset is at a certain price. This is helpful in case you want to buy a security and you are waiting for it to decrease.

The section “News Feed” allows users to interact and learn from each other by sharing their opinion and experiences.

In “Discover” you will find: “Instruments”, “People” and “CopyPortfolios”. As we mentioned before, the trading instruments available on are:

- Cryptocurrencies

- ETFs

- Shares

- Commodities

- Forex trading

- Index funds

In the tab “People” are all the profiles and historical performances of other users, and you can replicate their strategies with just one click. This is where the “social trading” concept is best applied.

Through the search engine, you can find the users that you find more interesting: by risk level, types of financial assets, average earnings… You just have to type the amount of your investment and eToro will replicate the movements of the selected investor, in proportion. This means that if you have $ 1000 and the trader puts 10% of his or her balance in an asset, eToro will invest also 10% of your money (in this case $ 100) in that same asset.

Also, here you will see CopyPortfolios classified into: Top Trader, Market, and Partner.

Sometimes you might prefer copying to CopyPortfolios than to particular investors, because the former offer more diversity. Besides, the different portfolios are easily identifiable: one about gaming, another about large drone companies, another about pharmacy … You think that a certain sector will prosper anytime soon? Then you will surely find a CopyPortfolio about it.