Contents

eToro, our reccomended broker for investing in Ethereum Classic from India

Some of its benefits are:

- You are able to imitate other investment strategies

- Allows you to go short

- User-friendly and simple

- You can trade leveraged

- Allows you to invest in tons of other products

Main site: www.etoro.com/ethereum-classic

In case you are considering it, eToro is the best way to buy Ethereum Classic from India.

eToro is famous for making “social trading” a trend. Social trading is a revolutionary way of investing in which traders can emulate the strategies of other investors who have been generating income over time.

eToro is very helpful if you are still a beginner in trading. You can rest assured that you are doing a smart investment move when replicating those from subjects with a long profit record. Additionally, in case you do have experience in investment, the platform pays you for sharing it.

It is also worth mentioning how easy is to manage the platform, ideal for beginners who are starting with Ethereum Classic.

Is eToro reliable for purchasing Ethereum Classic?

eToro is very rigorous with the information about past performances from users, and its integrity has been tested several times times by independent organizations.

The main headquarters of eToro is in Cyprus, and the platform is certified by the CySEC or Cyprus Securities Market Commission, which can cover up to € 20,000 from its client's debts. The platform complies, on the other hand, with all the strict policies of the European Union.

eToro is backed by the European Financial Instruments Market or MiFID, and by the Financial Conduct Authority (FCA) in the U.S. Apart from the above, it has a trajectory of fifteen years, with more than 20 million users around the globe. So, you can be sure that your money is safe.

Their customer service functions perfectly. You can use the ticketing system, an online chat, and they also have a phone number available for assistance.

eToro deposit methods

Within the payment options that you will find on eToro are: credit card, PayPal, bank transfer, Neteller, and Skrill. Depositing funds with eToro is so simple: click “Deposit funds”, type a number and select a payment method from the previous ones.

Consider that for security policies, you need to be the holder of the credit card or the account.

The minimum amount allowed is $ 200, and there is a maximum limit for unverified accounts. Thus, if your intention is to deposit larger sums, you will need to verify your account previously.

The platform accepts deposits in any currency, but you will have to pay a fee for the conversion to USD. That is why we recommend, if it is in your hands, using USD directly.

If you still don't know what “leverage” is, we'll describe it briefly: it is the possibility to invest a higher amount than you actually have. For example, if you start with $ 100 and you leverage x2, your initial investment will be $ 200.

About leverage, Take Profit and Stop Loss

Suppose now that you are sure that Ethereum Classic is going to appreciate, thus you decide “going long”.

You are positive that Ethereum Classic will go up, but you can only invest $ 1,000. Isn't it a shame to miss out on the possibility of earning more money?

There's the possibility of requesting a loan, but it is a process that takes time, and by the moment you receive the money, Ethereum Classic might be already so expensive (if your guess was right) that trading wouldn't be convenient anymore.

Leverage is like a credit, and you will only have to click a few times! You will be able to operate with much higher amounts than what you actually have on the platform. Before trading, you will find the leverage options as in the image below:

With other assets, the leverage you can choose is higher. Why? Because cryptocurrencies are a value that is invested in the medium-long term, and leverage is used mainly for day trading or short-term operations. That said, I'm going to explain better how leverage works.

You begin with $ 1,000 and decide to use leverage x2, which means you would have $ 2,000 to invest, since eToro would put the other $ 1,000.

A week later turns out that Ethereum Classic goes up and now the value of your investment is 20% higher, which means, you have $ 2,400 in Ethereum Classic. So, a wise decision is to sell them back now.

You will have to give back the $ 1,000 of leverage and the net profit would be $ 400 (since the other $ 1,000 was your initial investment).

With $ 1000 you get $ 400, in other words, 40% more. That's not bad at all.

Still wondering where the catch is? The trick is that the risk of losing out is also there. If everything goes as you planned, you will earn profits in little time; but if the opposite occurs, you will also lose more really fast.

For instance: if the price falls by 10%, you won't lose $ 10, but twice (the leverage) that figure, that would be $ 20. For that reason, when using leverage it is fundamental to know other two terms: Take Profit and Stop Loss.

Take Profit is an automatic order of selling once the asset achieves a certain price: you purchase Ethereum Classic at $ 100 and you ask eToro to close your position as soon as the price reaches $ 120. It is very helpful to avoid being blinded by greed: we would all take a 20% profit when making the investment, but when you reach that 20% it is easy to want higher profits and put yourself at risk of losing money. It's like you made sure now of not acting recklessly in the near future.

Also, if you use leverage you absolutely need to place a Stop Loss order (take into account that any small loss is greater with leverage). Always remember to mark a Stop Loss lower than that suggested by the platform.

Exchange-Traded Funds

What do you know about Exchange-traded funds? They are passively managed funds, known for merging the advantages of stocks and mutual funds: they can be traded regularly at market price, but include a much wider diversity of assets and the fees are significantly lower.

Stocks

Stocks are the most common financial assets. Some publicly traded enterprises divide their capital into portions and have several shareholders. By investing money in them, you can own a portion of a company and obtain returns.

Basically, there are two kinds of shares: those of companies that distribute their earnings among the shareholders and those that don't pay regularly. But this is not to say that those of the second type have less to offer. If a company does not pay out dividends but has a lot of potential, it can still represent a good inversion, since selling the shares eventually could pay much more.

If you invest in shares that payout, you will receive the funds into your eToro account, and you can withdraw them or invest back. Nevertheless, you can take advantage of compound interest, so our suggestion is that you reinvest.

Take into account that when investing in shares on eToro you can use leverage to “dope” your trades, but in that case, you will not receive dividends as the trade would be a CFD. For long-term investments, it is better not to use leverage: you can end up losing money, since you will not get dividends and, on top of that, you will have to pay commissions while your operation is open.

About Index Funds

If a long-term investment sounds like something you would do, and you won't need to withdraw your money in five years or maybe a decade, index funds can be the best choice. This kind of investment is also suitable for beginners since it is safer.

You may think differently, but beating the benchmark is far from being a piece of cake and very few fund managers achieve that, apart from some specific cases.

In practice, all that glitters is not gold: if a fund manager achieves to beat the benchmark, it is only for a short time or on a specific occasion. Or perhaps they would charge very high rates and indexing would be a better decision anyway (with minimal commissions).

With index funds, you don't have to worry about that: although in the long term, they frequently beat active managers, and the commissions are lower than you imagine.

Raw materials

The main benefit of investing in commodities is that their price fluctuates less than that of other financial assets. In fact, their intrinsic stability is what makes most investors trade with raw materials when facing financial insecurities or market volatility. Still, the cost of raw materials is determined by supply and demand, so if faced with the fear of inflation, demand rises a lot, so will the price.

Consider that raw materials don't pay dividends. So, by investing in them you will only have a further profit by selling them back.

There are two basic kinds of commodities: hard raw materials and soft raw materials. The former include precious metals (such as gold, silver, copper, and platinum), industrial metals (for instance, iron, nickel, or aluminum), and oil; and the latter are agricultural goods, such as sugar, coffee, corn, soy.

How to use eToro

We mentioned previously that eToro is very easy to manage. Anyone can start investing without previous knowledge or long explanations.

If you have used any of the most popular social networks today, you can perfectly use this platform.

We will explain, roughly, the registration process and the different sections that you will see.

You will have to provide some personal information (like full name or address, for instance) when registering.

During the sign-up process, you will also have to answer some questions about your previous investment activities.

But don't worry: it's not about passing an exam. They only intend to know how much knowledge you have and what type of financial instruments they can suggest. For instance, if you have never invested before, they will not recommend that you invest in futures.

Let's see what the different sections of the page are.

In the “Set Price Alerts” tab, you have, as its name says, the possibility to put alarms on the price of certain securities. You just have to click on the three points at the end of the line and you will be able to program a price alert. This is very helpful when you are after an asset that is falling, but perhaps you think that it will decrease even more.

In “News Feed”, investors interact and share opinions, tips, and other valuable information.

In “Discover” you will find the investment tabs: “Instruments”, “People” and “CopyPortfolios”. And we discussed previously in this guide the different financial instruments on eToro:

- Cryptocurrencies

- ETFs

- Stocks

- Raw materials

- Currencies

- Index funds

In the section “People”, you will find eToro users and their performances. This is where the term “social trading” makes sense since you can replicate with just one click the movements of the traders that you prefer.

You will be able to find those traders that you find more interesting. When you select an investor and indicate the amount you want to invest, eToro will automatically replicate their movements, in proportion. If you have $ 1000 and the user puts 20% of their funds in an asset, the platform will put $ 200 of your balance in the same asset or company as well.

You will also see the three main types of CopyPortfolios, which are classified into “Top Trader”, “Market” and “Partner”.

The benefit of using CopyPortfolios instead of copying people is that this way the risk is more diversified. There are all kinds of portfolios that you can find easily and are classified by sectors. Therefore, if you suspect a specific sector, such as biotechnology or healthcare, has a good chance of prospering, you can look for that specific portfolio and invest in it.

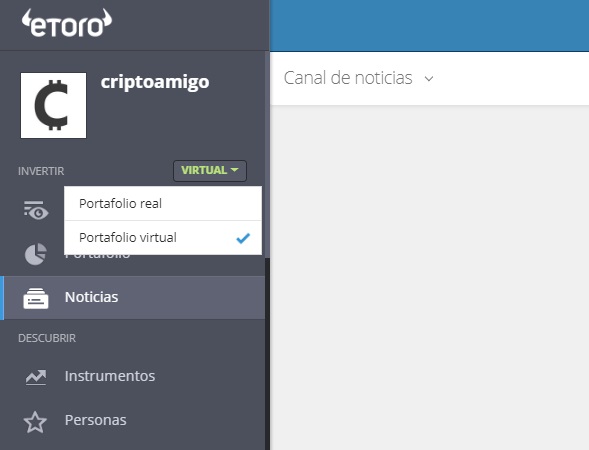

How does a virtual portfolio work?

For those who still don't have much experience in investing, using a demo account can be useful. Just make sure the virtual mode is set and you can start trading with fictional funds.

A virtual portfolio can be a good way of gaining confidence before starting to trade with real funds. When you open your demo account, you will begin with a virtual amount of $ 100.000, to operate with a variety of assets available on eToro, besides Ethereum Classic.

Don't worry, since if you lose all your virtual funds, you can contact support so they can add them back to your demo account and you can make a second attempt.

Keep in mind that trading is mainly about being cold-minded, and perhaps using a demo account can make you a bit impulsive. It will never be the same as risking your own money.

Finally, the demo mode is kind of pointless if you intend to trade in the medium or long-term, since you would be wasting years to see the outcome. Virtual accounts may be helpful for trying out before investing in the short or medium-term.